Instead of relying on second-hand information, spend some time with an experienced, reputable real estate professional who can give you the facts.

There are thousands of people who believe, for one reason or another, that they can’t afford to buy a home right now. Some people may not be able to for any number of reasons. However it may be surprising that some people who actually can qualify to purchase a home don’t, solely because they received some bad information when they first started looking. It’s worth digging a little deeper to find out the facts.

John and Karen have been renting a home for the last five years at $2,000 a month. During that time, the value of the home they were renting went up by $30,000 in value, while the unpaid balance on the mortgage decreased by $18, 400. Even though they were fortunate enough to have their rent remain constant over those five years, they missed out on nearly $50,000 of equity that the property’s owner realized instead of them.

Also, with today’s low interest rates, it’s quite common for a mortgage payment to be lower than what a tenant is paying for rent for a similar property. So, in this example, John & Karen also paid more over that period than they would have if they were making house payments and getting the benefit of equity growth.

It is true that not everyone can afford to buy a home. A down payment and closing costs may be too much of a burden at this time. Buyers also need to have steady income and good credit to qualify for the mortgage. But if you are interested in buying a property, why not talk to a real estate professional to find out if there is a way to make it work.

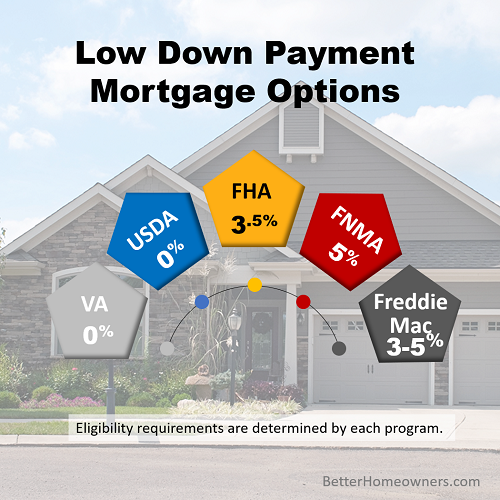

There are many low-down payment mortgages available, including 100% financing for qualified veterans and USDA eligible buyers. Additionally, while it may be difficult to find sellers willing to pay all or part of a buyers closing costs, lenders do allow it. It is a matter of finding the willing seller who can see the opportunities they may receive from selling their property at that time..

The source of a down payment could be a gift from a family member, as long as there is no repayment expected. Many parents or grandparents are willing to help a relative get into a home. Funds for a down payment may be available as loans or withdrawals from qualified retirement programs like IRAs or 401k plans. It’s worth investigating options you may have based on the retirement programs available to you.

Good credit is necessary to qualify for a loan but buyers should not assume that theirs is not adequate. A trusted mortgage professional can assess a situation and may be able to suggest some actions that will not only raise your score enough to be approved for a loan, but may possibly even raise the score enough to qualify for a better interest rate.

There are a lot of misunderstandings about whether a person can or cannot qualify for a home at this time. Instead of relying on word-of-mouth information or random facts on the Internet, spend some time with a real estate professional who can give you the facts, assess your situation and help you get in touch with a trusted mortgage professional.

If after reading this, you realize you may have been overlooking your actual buying power, call us at 510. 244.0085 to schedule an appointment so we can help you dig deeper to determine your true buying power.

Want more information? Download our Buyers Guide now.