Looking for a simple way to determine if a rental property delivers the rate of return you want? This modified annual property operating data may be just what you’ve been looking for.

Let’s look at different rates of return that investor’s consider to determine whether a property will generate the yield that they expect. Sometimes the simplest of calculations can tell you whether you should buy it or not. If you get other benefits like tax advantages and appreciation, it makes it that much better.

Cash-on-Cash ROR

Cash-on-Cash rate of return is the first yield we will look at. To calculate this, divide the initial investment, usually down payment and closing costs, into the Cash Flow Before Tax.

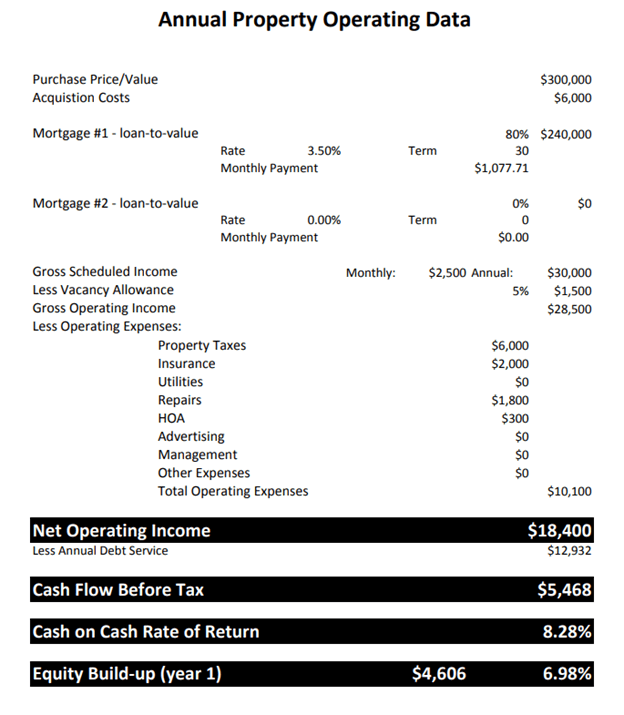

To arrive at Net Operating Income, take the gross scheduled income, less vacancy allowance and all operating expenses. Then deduct the annual debt service which is the principal and interest payment times twelve. The remaining amount is referred to as Cash Flow Before Tax.

In this example , we took the initial investment of the down payment and closing costs, $66,000 and divide into the Cash Flow Before Taxes of $5,468 to get an 8.28% Cash-on-Cash rate of return.

Equity Build-up

Next, let’s consider Equity Build-up. Each payment made on an amortizing mortgage pays a portion toward the principal balance to retire the loan. Calculate Equity Build-up by dividing the initial investment into the principal contribution for the year.

Continuing with the example, If you divide $66,000 into the principal reduction for year one of $4,606 you get a 6.98% Equity Build-up rate of return.

This approach is easy to understand because you are not considering depreciation, anticipated appreciation, holding period, recapture of depreciation or long-term capital gains. Simply rent the property, pay the bills and if there is money left over, it pays a return on the initial investment.

The same goes for the Equity Build-up. When you make your mortgage payment, you are reducing your loan. While you don’t have access to the money as you would with cash flow, it is definitely your equity and tangible.

To determine whether an ROI on a rental is good, compare it to what your initial investment is earning currently. Ten-year treasuries are earning less than 2%. Certificates of deposit currently earn less than 1%.

Operating Data

If you’d like help with these rental return on investment calculations, and help finding the right rental properties that will produce the type of rental rate of return you want. Contact us at Sound Investments, Inc. By calling us at (510)-244-0081 or CLICK HERE and leave us your information