There are so many types of mortgage that you can apply for. But, you may find yourself asking, “What do I qualify for?” “Are there any hidden charges?” “Is this really the best choice for me?”

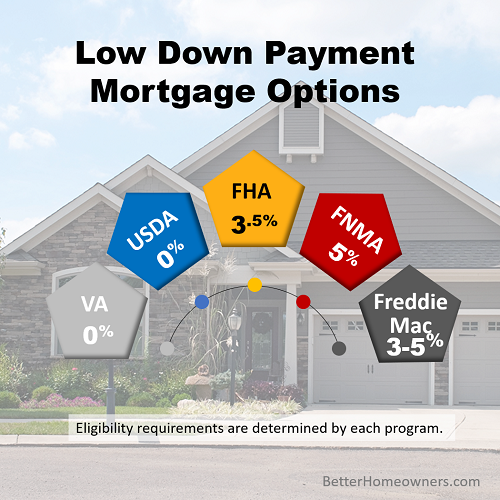

On top of that, so many companies advertise that THEY have the best, low down-payment option available. If you’re confused because there are too many options, let’s talk. We’re here to help!