Paying Points on Your Mortgage

One way to lower your mortgage payment is “paying points” on your mortgage. This means to buy down the interest rate for the life of the mortgage with discount points at closing. A discount point is one percent of the mortgage borrowed. Lenders collect this fee up-front to increase the yield on the note in exchange for a lower interest rate.

Two other commonly used ways to lower your mortgage payments are to make a larger down payment (especially if it eliminates private mortgage insurance) and improve your credit score before applying for a mortgage. However, you may get additional benefit from paying points on your mortgage

Here’s an Example

Let’s look at two options on a $315,000 mortgage for 30 years at 4% interest with no points compared to a 3.75% interest rate with one-point. The principal and interest payment on the 4% loan is $1,503.86. Compare this to $1,458.81 on the 3.75% loan.

The $45.04 savings is available because the buyer is willing to pay $3,150 in points. By dividing the monthly savings into the points paid, you can determine the breakeven point. In this example, if the buyer is plans to stay in this home for at least 70 months, they would recapture the cost of the discount points. Each month after that would realize savings.

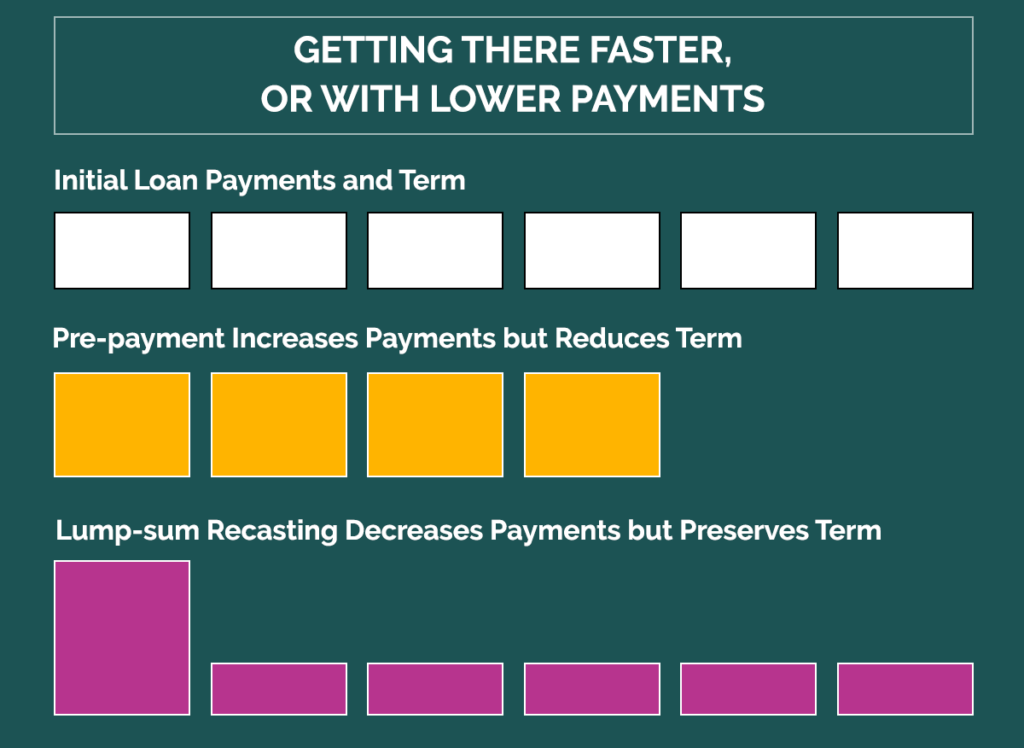

Accelerating Amortization and Tax Benefit

Another interesting thing to consider is that lower interest rate loans amortize faster; in other words, they build equity faster by paying off the loan sooner. If the buyer stayed in the home for 10 years, their unpaid balance in this example is $2,117.38 lower than the 4% mortgage. Combine that with the $2,259.29 in savings from the breakeven point to the end of 10 years and the buyer. This makes the buyer is $4,372.67 better off buying down the mortgage by paying the additional points.

For a person buying a home, it is sometimes difficult to come up with the extra amount for the points. However, an additional benefit you have is that the points paid are considered interest by IRS and can be deducted in the year paid.

How Do Discount Points Work?

A rule of thumb commonly used is that one discount point lowers the quoted mortgage rate by ¼% or 25 basis points. A lender may quote X% + .6 points for a mortgage. Using this scenario, to lower the mortgage rate by .25%, the buyer would need to pay 1.6 points. It is important to note that each lender determines the pricing of points for the loans they make.

It may be beneficial to a buyer to pay points depending on how long they plan on being in that home. Learn more about whether you should consider paying points. Use this Will Points Make a Difference calculator and download the Buyers Guide.