The 2022 Conventional Conforming Mortgage Loan Limits for properties with one to four units have been released. These limits are shown in the table below. Please note that the majority of counties in the San Francisco Bay Areas are considered High-Cost Areas. For a list of Bay Area Counties and their loan limits, please see our previous post, “Conforming or Jumbo Mortgage Loans.”

| Low-Cost Area | Medium-Cost Area | High-Cost Area | |

| 1 Unit | $647,200 | $647,201-$970,799 | $970,800 |

| 2 Units | $828,700 | $828,701-$1,243,049 | $1,243,050 |

| 3 Units | $1,001,650 | $1,001,651-$1,502,474 | $1,502,475 |

| 4 Units | $1,244,850 | $1,244,851-$1,867,274 | $1,867,275 |

Change From 2021

The Conforming Mortgage Loan Limits in California for high-cost areas have been increased approximately 18% in response to higher property values. This means new buyers can now borrow up to $148,425 more than in 2021 and still qualify for a conventional loan.

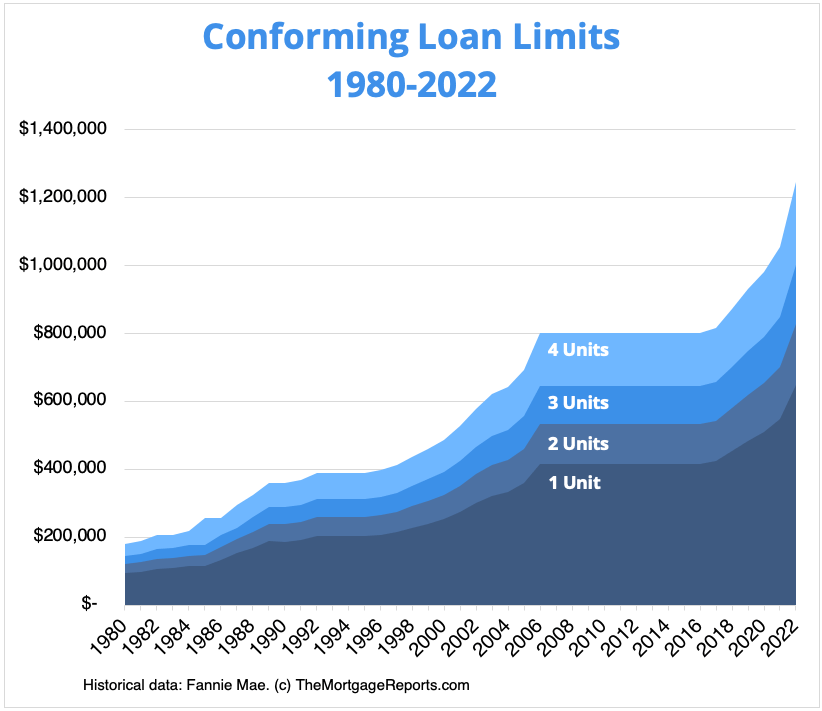

As you can see from the chart below from TheMortgageReports.com, after a lengthy plateau between 2006 and 2017, conforming loan limits have been rising faster than ever before.

What This Means To You

Both conventional and jumbo loans may be available to you. But this increase in limits gives you a better chance to be able to qualify for a conforming loan and takes into account the aggressive California housing market.

Conforming loans offer some advantages for those looking to purchase a home. Whether you are a First Time Home Buyer or a seasoned investor, conforming loans have low-interest rates at great terms. This translates to lower monthly payments.

You can put down as little as 3% and the loan process for a conforming loan is very efficient. It allows for 2-3 weeks closing periods if the buyer and seller are in a rush to close quickly. Another great aspect of conforming loans is that you might get an appraisal waiver. This helps save on costs and can speed up the closing process.

Limit Your Risk

According to LendingTree Chief Economist Tendayi Kapfidze, the most significant risk for buyers with any loan is lack of understanding. “Once you get a loan, the risk is all with the lender. [For borrowers,] the risk with conforming loans is just better understood than non-conforming loans. This was proven out during the financial crisis.”

Therefore Kapfidze encourages consumers to do their homework before filling out any loan application. “Different lenders are going to give different prices and interest rates to the same borrower,” he said. “Even within the guidelines, lenders choose which market to address. For certain high-interest areas of the market, they may price more aggressively. However, since you don’t know each lender’s strategy, talk to more than one. There may be a lender that fits better with your financial picture.”

Getting a home mortgage loan is usually the single most impactful financial decision people make in their lifetimes. So shop around and get the help of an expert before you sign on the dotted line. Contact Sound Investments by filling in the form available HERE. Our experience in mortgage brokerage can guide you to a loan that best fits your needs.